Technology: Blockchain Banking and How Distributed Ledger Technology Is Revolutionizing Finance.

Invention

Blockchain is a distributed, decentralised ledger system that keeps track of digital transactions across several computers. The fundamental aim is to guarantee that the transaction record is transparent and resistant to tampering (Nakamoto, 2008). The technology, first intended to serve as a public ledger for Bitcoin transactions, is quickly becoming the norm in the digital and financial industries. Its popularity has risen with the emergence of cryptocurrencies, particularly Bitcoin, which uses blockchain as its underlying technology.

Organisation

Transactions are organised into blocks on a blockchain. Each brick is rigorously checked before being added to a chain of previously authorised blocks. The blockchain is made up of this chain. Importantly, each block contains critical transaction information, such as the sender, recipient, and the amount of assets transferred. Furthermore, each block has a unique identifier called a cryptographic hash, which is critical in ensuring the blockchain's integrity and security (Tapscott and Tapscott, 2016).

The decentralised nature of blockchain technology is its most distinguishing characteristic. Unlike traditional financial systems centralised with authority organisations, blockchain runs on a peer-to-peer network. Because all network members must independently authenticate transactions, this decentralisation increases transparency and is immune to censorship.

Security

Another critical aspect of blockchain technology is security. Once a block is uploaded to the blockchain, it is permanently recorded. This immutability limits an attacker's ability to modify the transaction record, making the blockchain cryptographically safe (Miers and Garman, 2016).

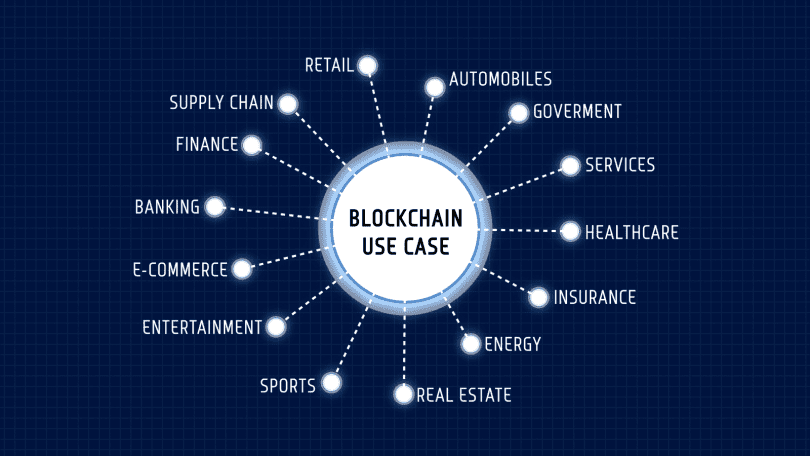

In reality, blockchain technology has users beyond cryptocurrencies and financial services. Its openness, security, and decentralisation make it an appealing alternative for supply chain management, healthcare, and political systems looking to strengthen confidence and transparency. Blockchain technology is, without a doubt, revolutionary. It has enormous potential to improve security, transparency, and efficiency across several industries.

The banking sector is only one of the many industries that blockchain can upend. It has been called one of the most disruptive technologies of our time. Banking systems have traditionally been centralised, with all transactions passing through the bank. The decentralised aspect of blockchain threatens to upend this decades-old tradition and, as a result, change how transactions are handled.

Blockchain technology employs a distributed ledger, which allows data to be saved across several computers worldwide. The saving provides data integrity and fraud prevention since any modifications made are practically tamper-proof because they must be confirmed across all machines in the network (Papadopoulos, 2019). More secure transactions and data security for banks help ensure client confidence, which is a critical building component for every financial organisation.

Fast and cost-effective.

Furthermore, due to the participation of several intermediaries, foreign transactions in present banking systems are riddled with delays and costly fees. Transactions employing blockchain technology, on the other hand, may be conducted in real-time, regardless of geographical location (Vigna & Casey, 2016). Ripple, a digital payment system, employs blockchain technology to enable real-time, direct payments between parties, avoiding costly and time-consuming intermediaries.

Transparency

Blockchain equally comes with transparency in the banking sector. Transactions in traditional banking might be veiled in secrecy. However, there is improved accountability with blockchain's open ledger architecture, in which all transactions are recorded and available to network users. Transparency minimises the danger of financial fraud and increases the trustworthiness of banking operations (Tapscott & Tapscott, 2016).

Furthermore, blockchain technology is quite effective in cost control. Accenture estimates that it can save a bank's infrastructure expenses by up to 30% (Chishti & Barberis, 2016). This decrease is mainly accomplished through eliminating intermediaries and automating back-end activities using smart contracts.

One must recognise blockchain's potential influence on payments and money transfers. Traditional banks and financial organisations frequently employ old-fashioned methods that are sluggish, inefficient, and costly. Blockchain technology can address these issues by enabling peer-to-peer transactions that are quicker, more efficient, and less expensive. Blockchain payments are done in real-time and do not require go-betweens, dramatically reducing costs and increasing transaction speed (Tapscott & Tapscott, 2016).

Auditing

Additionally, the level of transparency and traceability of blockchain might change auditing and regulatory compliance. Every transaction on a blockchain is recorded on a decentralised ledger that cannot be changed. This characteristic has the potential to make audits less complicated and more efficient. The system's openness may also prevent fraudulent behaviour and facilitate adherence to regulatory norms (Mougayar, 2016).

Blockchain technology might also transform asset management. Real-world assets such as real estate or art may now be 'tokenised' and exchanged on blockchain platforms, thanks to the growth of tokenisation. This tokenisation can potentially democratise the financial business by allowing more people to engage in markets previously reserved for affluent or institutional investors (Tapscott & Tapscott, 2016).

Negatives

Despite its enormous application potential and numerous benefits, blockchain technology does not come without drawbacks. One of the most noticeable disadvantages of blockchain technology is its high energy consumption. Blockchain transactions entail significant processing power, requiring massive electrical energy, with Bitcoin being the most obvious example (Krause, 2018). According to one analysis, Bitcoin's yearly power usage exceeds that of certain countries. Such massive energy use strains the world's energy supplies, contributing to environmental damage.

Another disadvantage is the scalability issue that blockchain confronts. By design, blockchain technology lowers transaction processing time as the number of users grows. Every transaction requires verification by most network nodes, reducing processing speed and efficiency (Böhme, 2015). This verification makes using blockchain technology for large-scale operations complex and, thus, is a crucial barrier to its widespread adoption.

The third issue of blockchain technology is the need for more regulation and monitoring. Its decentralised structure makes it appealing but makes regulation and control complex. Unlawful acts or misuse, such as money laundering or fraud, may occur without regulation. Furthermore, decentralisation implies no centralised authority to lead action during crises or conflicts (Barber, 2012).

Finally, we must recognize the complexity linked with blockchain technology. To utilise it successfully, consumers and enterprises must have a certain level of technology literacy. Blockchain principles and procedures might be complex for ordinary people and even certain corporations. This intricacy impedes widespread adoption (Zheng, 2018).

The decentralisation, security, speed, transparency, and cost-efficiency of blockchain are upending the old banking paradigm. While blockchain may not instantly replace traditional banking systems, its continuous popularity shows that it will profoundly affect the future of financial services.

Technology: Blockchain Banking and How Distributed Ledger Technology Is Revolutionizing Finance.

Blockchain, a distributed, decentralised ledger system that keeps track of digital transactions across several computers, is fundamentally made to guarantee that the transaction record is transparent and resistant to tampering (Nakamoto, 2008). The technology, first intended to serve as a public ledger for Bitcoin transactions, is quickly becoming the norm in the digital and financial industries. Its popularity has risen with the emergence of cryptocurrencies, particularly Bitcoin, which uses blockchain as its underlying technology.

Photo:https://builtin.com/blockchain